PERSONAL FINANCE

Weighing the Pros And Cons of Homeownership: Is It Right For You?

Quick Synopsis:

Explore the pros and cons of homeownership to determine if it’s the right choice for you. Learn about the benefits, drawbacks, and key factors to consider before buying a home.

Weighing The Pros and Cons of Homeownership: Is It Right For You?

Homeownership is often seen as a hallmark of the American Dream, symbolizing stability, success, and financial security. However, the decision to buy a home is not one to be taken lightly. It requires careful consideration of your financial situation, lifestyle, and long-term goals.

In this blog post, we’ll explore the truth about homeownership, weighing the pros and cons to help you determine if owning a home is the right choice for you.

The Financial Reality of Homeownership

Owning a home is one of the most significant financial commitments you can make. While it offers potential long-term benefits, it also comes with substantial upfront and ongoing costs.

Upfront Costs

- Down Payment: Typically, you need to put down 20% of the home’s purchase price to avoid private mortgage insurance (PMI). This can be a significant amount, especially in high-cost areas.

- Closing Costs: These include fees for appraisals, inspections, legal services, and other expenses associated with finalizing the purchase. Closing costs generally range from 2% to 5% of the loan amount.

Ongoing Costs

- Mortgage Payments: Your monthly mortgage payments will likely be your most substantial ongoing expense. These payments include both principal and interest.

- Property Taxes: Homeowners must pay property taxes, which vary based on location and property value.

- Insurance: Homeowners insurance is necessary to protect your property from damage and loss.

- Maintenance and Repairs: Unlike renting, homeownership means you’re responsible for all maintenance and repair costs. This can range from routine upkeep to significant repairs.

The Benefits of Homeownership

Despite the costs, homeownership offers several advantages that can make it a worthwhile investment for many people.

Building Equity

One of the primary benefits of owning a home is building equity. As you pay down your mortgage, you increase your ownership stake in the property. Over time, your home may also appreciate in value, further boosting your equity.

Stability and Predictability

Owning a home provides stability. Unlike renting, where you may face rent increases or the possibility of having to move, owning a home allows you to control your living situation. Fixed-rate mortgages offer predictable monthly payments, making it easier to budget.

Tax Benefits

Homeowners can take advantage of several tax benefits, including deductions for mortgage interest and property taxes. These deductions can reduce your taxable income, potentially saving you money.

Personalization and Control

When you own your home, you have the freedom to customize and renovate it to suit your preferences and needs. This level of control allows you to create a living space that truly feels like your own.

The Drawbacks of Homeownership

While there are many benefits to owning a home, there are also drawbacks that you need to consider.

High Upfront and Ongoing Costs

As mentioned earlier, the costs associated with buying and maintaining a home can be substantial. It’s essential to have a clear understanding of these expenses and ensure you’re financially prepared.

Reduced Flexibility

Homeownership ties you to a specific location, which can be a disadvantage if you need to relocate for work or personal reasons. Selling a home can be time-consuming and costly.

Market Risk

The real estate market can be unpredictable. While homes typically appreciate over the long term, short-term market fluctuations can impact your home’s value. In some cases, you may owe more on your mortgage than your home is worth.

Is Homeownership Right for You?

Deciding whether to buy a home depends on various factors, including your financial situation, lifestyle, and long-term goals. Here are some questions to consider:

Financial Considerations

- Do you have a stable income? A reliable source of income is crucial for managing mortgage payments and other homeownership costs.

- Can you afford the upfront costs? Ensure you have enough savings for a down payment, closing costs, and an emergency fund for unexpected expenses.

- Are you prepared for ongoing expenses? Be realistic about the costs of property taxes, insurance, and maintenance.

Lifestyle Considerations

- How long do you plan to stay in the area? If you plan to move within a few years, renting may be a better option. Homeownership is typically more cost-effective over the long term.

- Do you value stability? If you prefer the stability and control of owning your living space, homeownership may be right for you.

- Are you ready for the responsibilities of homeownership? Maintaining a home requires time, effort, and money. Be sure you’re ready for this commitment.

Conclusion

Homeownership is a significant decision with both advantages and disadvantages. By carefully evaluating your financial situation, lifestyle preferences, and long-term goals, you can determine if owning a home is the right choice for you.

Remember, there’s no one-size-fits-all answer, and it’s essential to make a decision that aligns with your personal circumstances and aspirations.

Whether you choose to buy or rent, the most important thing is to create a living situation that supports your financial health and overall well-being.

How Our Services Can Help

Our financial advisory services are tailored to help you achieve your financial goals and desired lifestyle. We offer personalized budgeting advice, investment strategies, and income optimization techniques to ensure you build a strong financial foundation. Let us guide you through creating a comprehensive financial plan that aligns with your aspirations and sets you on the path to financial freedom.

Get Started Today

Schedule a free consultation with our expert advisors to begin your journey toward financial independence and lifestyle flexibility. Together, we can create a plan that empowers you to transition seamlessly into the next phase of your career.

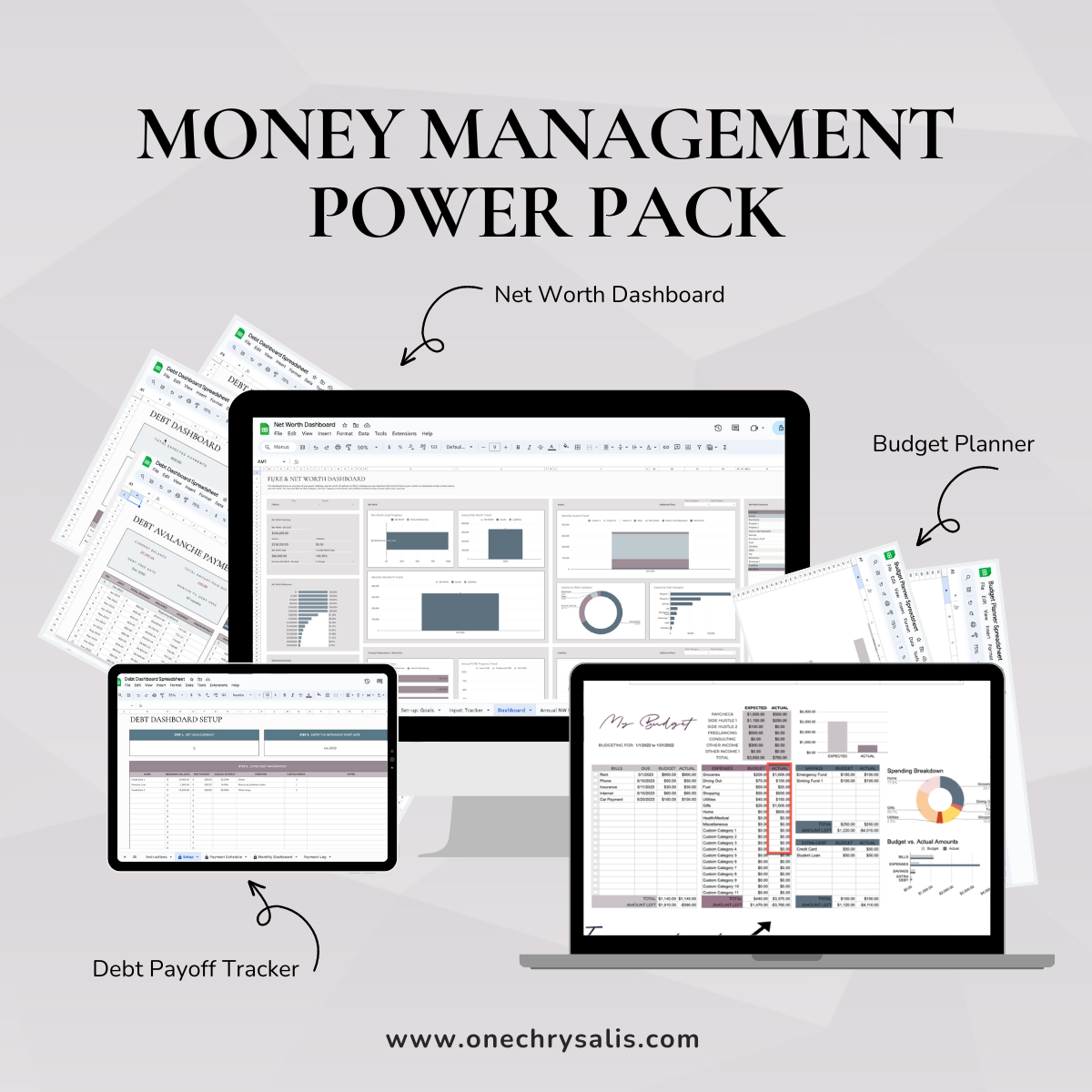

Ready To Take Control Of Your Financial Future?

Our Money Management Power Pack equips you with the resources needed to effectively manage your money, pay off debt, and track your overall financial health. Gain clarity and control over your finances and make informed decisions about homeownership.

About Us

At Chrysalis Capital Management, we’re committed to helping you embrace the abundance mindset as a cornerstone of your financial success. Through personalized coaching and resources, we guide you in aligning your mindset with your financial goals, helping you make empowered decisions that pave the way for a prosperous and fulfilling future.

I’m Stephanie

I empower women to achieve true financial freedom through expert wealth guidance and personalized coaching.

I’m not your typical financial advisor, I’m committed to redefining the way you approach wealth management. No more jargon filled, stuffy financial tasks – I’m all about making finances as exciting as that perfect getaway vacation.

Welcome!

Are You Financially Fit?

Test your financial fitness level with this 3 minute quiz!

TOP CATEGORIES

Financial Planning

Explore essential topics like budgeting, goal setting, and debt management to achieve financial security and peace of mind.

Investment Strategies

Dive into the world of investments, from understanding different asset classes to crefting effective investment strategies for wealth growth.

Retirement Planning

Discover insights and tips to ensure a comfortable and worry-free retirement, covering retirement income, savings plans, and financial security.